In recent years, U.S. homeowners have enjoyed a remarkable surge in home values. In the past four years, home prices have jumped by nearly 50%. But not every year produces the same appreciation growth. So what is the average home value increase per year?

In this post, we’ll look at average yearly increases, explore the factors driving home appreciation, how to calculate your home’s value, and how to leverage your equity as you plan your next financial move.

What is home appreciation?

Home appreciation refers to the increase in a property’s value over time. It’s driven by a combination of market conditions, buyer demand, and property improvements. It can be beneficial for homeowners and investors, as it can lead to:

- Higher equity: A higher home value can increase the amount of equity in a home.

- Larger profits: When a home is sold, a higher value can lead to a larger profit.

- Increased rental income: For investors, a higher home value can lead to increased monthly rental income.

While most homes naturally appreciate over the years, factors like location, nearby developments, and overall economic conditions also play a significant role.

What is the average home value increase per year?

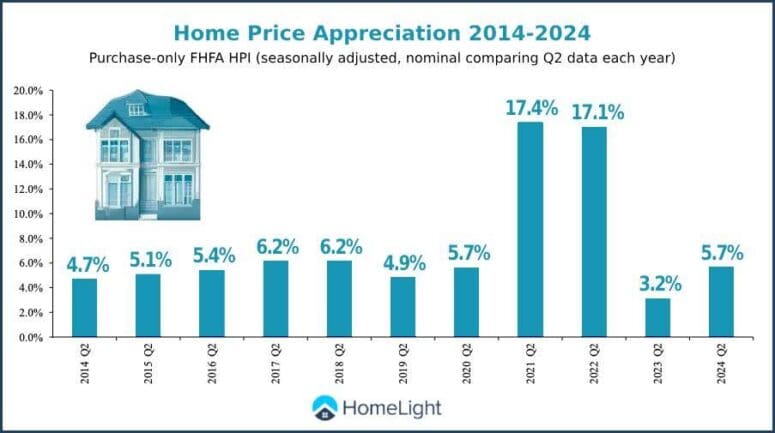

On average, U.S. home prices have risen at a rate of about 5% annually over the past decade, and at a faster average of about 8% per year over the past five years, according to data from the Federal Housing Finance Agency (FHFA) and the U.S. Department of Housing and Urban Development (HUD). However, appreciation can vary significantly from year to year. For example, while mid-year home prices surged by over 17% in 2021 and 2022, they slowed to 3.2% in 2023 before rebounding to 5.7% so far in 2024.

The chart below shows the percentage of home price appreciation for the past 10 years using second-quarter data from the FHFA’s House Price Index (HPI).

Market conditions, buyer demand, and inflation all impact these fluctuations. By keeping an eye on yearly appreciation trends, you can get a better sense of how much your home may have increased in value and what that means for your financial goals.

How do I estimate my home value?

Estimating your home’s value involves considering factors like recent sales in your area, the condition of your home, and local market trends. You can start by checking online real estate platforms that offer free home value estimates, or you can consult a local real estate agent for a more accurate assessment through a comparative market analysis (CMA).

Additionally, if you’ve made significant improvements to your home, those upgrades may further increase your property’s value.

Home value estimates are a good starting point, but keep in mind that an official appraisal will provide the most reliable figure when you’re ready to sell or tap into your home equity.

How do I estimate my current home equity?

Home equity is the difference between what you owe on your mortgage and the current market value of your home. To estimate your equity, subtract the remaining balance on your mortgage from your home’s estimated value.

For example, if your home is worth $500,000 and you owe $300,000, your equity would be $200,000. As your home appreciates, your equity grows, allowing you to borrow against it or sell the property for a profit. Keep in mind that calculating home equity is just one step — lenders will typically require a formal appraisal if you’re applying for a loan or home equity line of credit (HELOC).