“Too excessive to be credible.”

That’s what Shakespeare was trying to convey with this classic line from Hamlet.

Actually, the original line in the play was “The lady doth protest too much, methinks,” and it’s been misquoted over the years as “Me thinks the lady doth protest too much.”

But when used in urban slang, people often just say, “Me thinks thou doth protest too much” to sarcastically let somebody know that what the person is saying is not to be believed.

Why wouldn’t this person be believable?

The word “over-selling” comes to mind. Or “over-hyping.” Stating your point of view just a little too much; making it a bit “over the top.”

“Too excessive to be credible.”

Exaggerated. Excessive. Inordinate. Extreme.

Whether you’re familiar with the Shakespearian idiom or not, surely you could suss out an example or two on a daily basis, no?

When it comes to our monthly “TRREB Stats” blog post, it’s been suggested before that I’m a bit too chipper in my view of the real estate market.

I’ve seen a reader or two comment that maybe, just maybe, I’m choosing to see the market through “rose-coloured glasses,” since statistics are always open to interpretation, and can always be used to create an argument.

But in this space, I’m not looking to “create an argument.”

While some won’t want to see the words “honest” and “Realtor” used together, it’s truly my intention every month to provide a realistic take on the market by analyzing the TRREB stats.

Having said that, I have to recognize that my bullishness on the market has not been met with a corresponding increase in home prices, sales, or buyer sentiment over the last few months, and for that reason, you are free to conclude:

Methinks Thou Doth Protest Too Much

That’s fine. I can take it.

I can also take a viewpoint in opposition, so long as it’s backed up by something tangible, and at the conclusion of today’s blog post, I welcome your thoughts.

I’ve been saying for several months now that the real estate market is “ready to pop.”

Not pop like burst, ie. a bubble. No, no, sorry, market bears.

But rather “pop” like “explode.” Like popcorn, perhaps? Like this really cool vintage popcorn maker that I purchased and have had sitting my office for the last month, maybe…

We have yet to actually pop any popcorn. It’s in mint condition. I don’t want to ruin it…

In any event, you may feel free to agree or disagree with my view about the real estate market horizon.

I have gone on record here on TRB, noting my purchase of two properties in the last six months, as evidence that I’m not just a real estate mouthpiece.

But do the September real estate statistics show a market that’s “about to pop?”

No.

Absolutely not.

And that is as honest a take as you’re going to get.

So, allow me to present some data that will show the Toronto real estate market in a very negative light and then explain why I remain bullish…

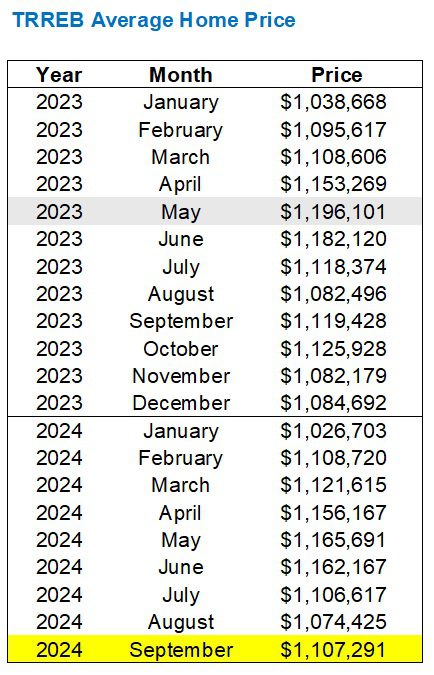

The average home price in the GTA increased 3.1% from August, now checking in at $1,107,291:

Note that this price is off by 1.0% from the September 2023 average home price.

There are two ways of looking at this; one positive and one negative:

- The September average home price is still down 5.0% from the 2024 “peak” in May

- The September average home price is only off 0.8% from September of 2023.

A pessimist will say, “Prices are off 5% since May! The market is dropping!”

But a realist might offer, “The average home price was down 6.4% in September of 2023, over May of 2023, so the fact that it’s off 5.0% this year isn’t surprising.”

Prices are usually lower in the fall than in the spring.

From 2002 through 2023, the yearly “peak” price occurred in the spring 14 times compared to 8 times in the fall.

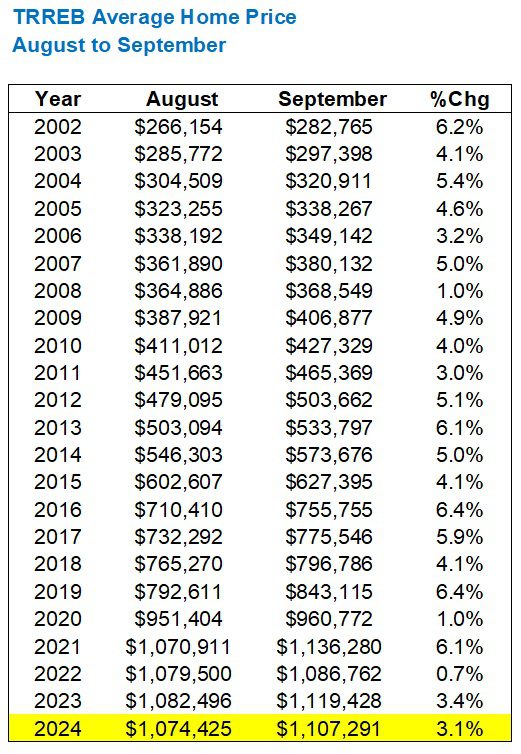

As for the expected increase in average home price from the summer to the first month in the “busy fall market,” that 3.1% increase from August was significantly lower than I expected, but somewhat in line with the trend:

I say “somewhat in line” because the average increase from August to September from 2002 through 2023 is 4.4%.

However, the 3.1% increase is on par with last year.

I came into this month “needing” to see a 5.0% increase, putting the TRREB average price somewhere around $1,128,000, to feel that the market had picked up as expected. But we’re not quite there…..yet…

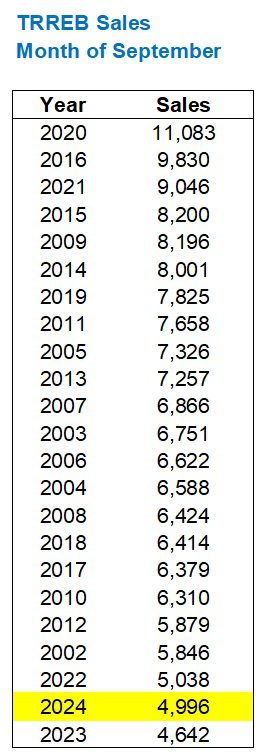

As for sales, here’s where the market bears begin to growl.

Sales were up by 8.5%, year-over-year, but when you consider where sales were in September of 2023, this doesn’t exactly exude confidence about the market…

“We did it! We beat out the lowest sales in any month of September, ever!”

Yes. By a whopping 0.4%.

Now, I would expect sales to absolutely skyrocket in September over August.

Wouldn’t you?

The summer is slow! The fall is busy! We all act like the real estate market explodes in September like a poorly-built knock-off popcorn machine, but does it?

Check this out:

This was very surprising to me!

Ten times in the previous twenty-two years, we saw sales decrease from August to September.

I never would have thought.

So with sales nearing an all-time low in September, does that mean inventory was also low?

Nope.

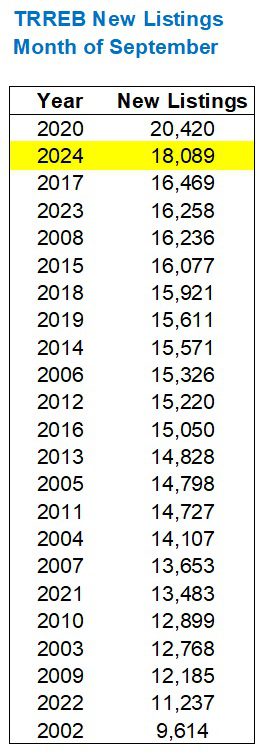

In fact, it’s rather interesting that after seeing the second-fewest sales in any month of September, we saw the second-most new listings:

That’s a lot of new listings.

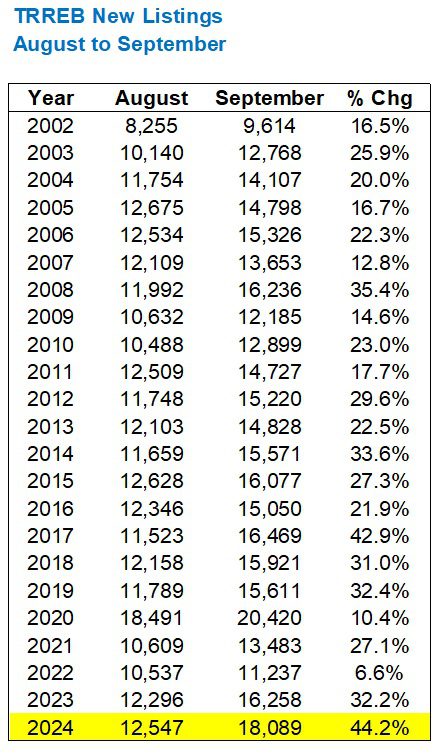

And if you look at the next chart, you’ll conclude, like I did, that a lot of people waited through the summer to list in the fall:

That’s the increase in new listings from August to September, and the 44.2% increase we saw last month is the highest of any year analyzed since 2002.

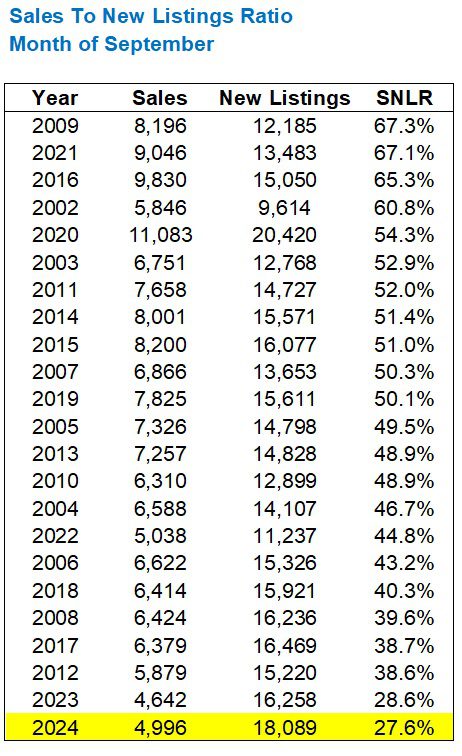

The result, as you might expect, is the lowest absorption rate in any month of September:

That’s putrid.

And having said that, I ask the following:

With an absorption rate of 27.6%, how in the world did prices increase?

This is the funny thing about our market.

As I have noted before many times in this space, if you saw this level of disparity between supply and demand in another market for goods or services, you would expect prices to plummet.

But prices haven’t.

Yes, yes, feel free to tell me that prices are down from the peak in February of 2022, or that prices are down by 1.0% from September of last year.

But the absorption rate is as low as I have ever seen it, and prices are hardly moving.

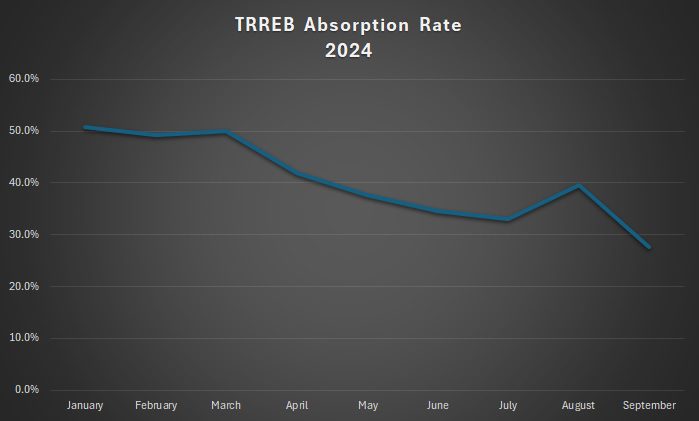

Excuse the unsexy chart, but have a look at the absorption rate so far this year:

Not a sexy chart.

And not a sexy statistic either!

If the 50% threshold represents the difference between a buyer’s market and a seller’s market, then what the heck do you call this?

The five major TRREB districts – Toronto, Halton, Peel, Durham, and York are all moving in tandem this month, but historically, this is when inventory beings to tighten up:

Note that the 416-Toronto, amazingly, saw the lowest absorption rate last month.

So with all this said, and with all these statistics, why do I remain bullish?

I got out ahead of this blog post by offering my thoughts in Friday’s podcast:

The Last Honest Realtor – “Is Toronto’s Real Estate Market About To Turn Around? What The Numbers Say”

The commenters still aren’t feeling the irony in the LHR title, but I suppose not everybody can be in on the joke.

YouTube comments typically don’t offer Harvard-educated, Pulitzer prize winning insight, but they do allow us inside the mind of the “every-man.”

Here’s one:

Ironic you call your channel the last honest realtor and your sole mission is to pump the market up for more sales. Prices historically move down when interest rates drop rapidly. The Bank of Canada is only dropping rates if the economy is in trouble.

This is what I’m seeing out there right now.

It’s utter ignorance.

“Prices move down when interest rates drop.” That’s the exact opposite of what happened in 2020 when rates were slashed and prices skyrocketed.

The best argument that bears have to the contrary has always been “your sole mission is to pump the market up for more sales.”

As I’ve said for a long time now, I sell real estate in any and every market. Up, down, or sideways. I couldn’t possibly care less what the market is doing.

Here’s another comment:

Catch a falling knife! What great advice. No the real reason no one is buying is really really simple. The expectation of a capital gain is gone.

The expectation of a capital gain is gone?

Really?

I mean, for one week, or one month, sure.

Tell me it’s four months. Or six. Or even a year.

But do the YouTubers really think the average home price in Toronto won’t be higher in the spring of 2025 than it is today? Or the fall of 2025? Or the spring of 2026?

“The real reason nobody is buying is really simple.”

I agree.

It’s fear.

And it’s human nature.

As I wrote in a previous blog post, buyers don’t like buying at the bottom.

Buyers always buy on the way back up.

Not all buyers, but most.

In the Toronto real estate market, people have grown so accustomed to a seller’s market that buyers are actually uncomfortable working in a buyer’s market.

How’s that for irony?

While the average buyer would never acknowledge this, let alone admit it, a buyer feels better “winning” in competition on a home in a multiple-offer scenario than buying a home after it’s been on the market for 58 days, with two price reductions.

But that’s human nature, right?

Buyers constantly complain about “offer dates” and “bidding wars” but there’s something truly invigorating about knowing that you beat eleven other buyers and their respective offers on an underpriced home.

Buyers all want to offer under the list price on a home and actually get to negotiate, but in doing so, that buyer wonders, “Should I be doing this? Why has nobody else bought this house? Is this the right time?”

When everybody is buying, people can convince themselves that their decision to buy makes sense.

They will pay a higher price, but when you can look at the front cover of Toronto Life and see an image of a house on fire, because the market is so red-hot, you can much better at night.

Today’s buyers are taking full advantage of the market dip and while they’ll have to pay a higher interest rate on their variable–rate mortgage for three, six, or nine months, they know they can lock into a traditional five-year, fixed-rate mortgage in 2025, and come out well ahead of next year’s buyers.

I remain convinced that those spring, 2025 buyers will pat themselves on the back for waiting until a 5-year, fixed-rate mortgage hits 3.79%, but you couldn’t convince them that the house they’re buying is 10% more than it was in September.

In the meantime, the notion of prices dropping is wishful thinking.

Try this statistic on for size:

The absorption rate in 416-Toronto in September was the lowest of the five major TRREB districts, at 25.6%, down from 38.5% in August.

But the average home price in 416-Toronto in September increased by 8.2% from $1,029,069 in August to $1,113,671 in September.

Me think thou doth protest too much?

Sure.

But don’t forget:

“The fool doth think he is wise, but the wise man knows himself to be a fool.”