Scotiabank has no problem extending an 80% loan-to-value on investment properties, but they charge a 25 basis-point premium.

TD Bank doesn’t charge the 25 basis-point premium, and their rates are very competitive, but they insist on a 75% loan-to-value.

HSBC wants to be a player in the investment property space, but if you’re purchasing through a trust or holding company, their requirements make obtaining a loan next to impossible.

There’s a common misconception out there that all banks and lenders are the same, all offerings, rates, packages, premiums, discounts, requirements, and processes are the same but in 2024, every lender is so different from the next that I don’t think we’ve ever had this level of deviation from the mean.

Not only that, I can’t recall the last time we had this level of: a) uncertainty, b) confusion, in the mortgage market.

A long-time industry colleague mused the other day:

The average person didn’t know what an interest rate was until March of 2020 when the Bank of Canada slashed rates at the onset of the pandemic. But the average person also didn’t know what an interest rate did until we saw increases start in 2022.

It was a very interesting observation, but it really made me think.

If I’m looking at myself, I would say that while I went to school for economics (a very long time ago…) and I’m quite familiar with fiscal and monetary policy, I will admit that I observe the Bank of Canada’s movements much more closely in 2024 than I did in 2004.

Was this my colleague’s point? Or was he trying to be more cynical and essentially infer that nobody ever cared about interest rates until we saw the most aggressive cycle of rate hikes of all time?

Of course, if we take his comment at face value, we could also quite fairly conclude that:

1) People have been following interest rates much more closely because they increased ten times and caused prices to decline.

2) People have been following interest rates much more closely because they have since decreased three times, with more on the way, and they could/might/will cause prices to increase.

Some people are still not in the “will” camp and are finding trouble getting into the “might” or “could camp,” and amazingly, there are still some out there who are calling for real estate prices to decline even as we approach five-year, fixed-rates in the 3.99% and below range.

I live and breathe the news media as it pertains to real estate and last week, I think I saw more coverage on the mortgage market than ever before.

More importantly, each and every headline seemed to undermine or contradict the one before it! Talk about confusing!

But the conversations we’re having are important since, in my opinion, the trajectory of the real estate market and the overall landscape will be most dependent on the lending market as we move forward. No, I’m not just talking about interest rates, but rather the entire mortgage market, including the products the lenders are offering and the CMHC guidelines in place today, and up for debate tomorrow.

Case in point:

“Canada’s Mortgage Stress Test Is Hurting The Buyers It Was Meant To Protect”

The Globe & Mail

September 12th, 2024

From the article:

Let’s look back to 2016: interest rates were low, and homebuyers were active, potentially taking on more mortgage than they could afford, according to the Office of the Superintendent of Financial Institutions. The stress test was introduced to ensure Canadians could carry their debt, should interest rates rise.

Rising interest rates didn’t happen for some time, with the Bank of Canada dropping its benchmark interest rate to near zero during the pandemic, and many lenders’ posted rates at multiyear lows.

At the time, it was wise to take steps to safeguard Canada’s financial system, by testing the qualification of high-ratio borrowers against a rate of either 5.25 per cent, or their contracted rate plus two percentage points – whichever was higher. The stress test was credited with preventing a swath of foreclosures when rates eventually started climbing in 2022 and 2023.

But in today’s higher interest-rate environment, it has become counterintuitive policy, serving only as an additional barrier for first-time homebuyers. Reports show that over the last couple of years, lack of affordability and high interest rates have sidelined first-time buyers in Canada’s major housing markets, while those who do not need to borrow as much – such as move-up buyers and some investors – are taking advantage of softer values and healthier inventory levels.

Entry-level buyers have all but disappeared from cities where they grew up and have roots, such as Vancouver, Toronto, Calgary and even Halifax to an extent. Without significant savings, financial support from the Bank of Mom and Dad, or a strategy to address ongoing housing supply issues, first-time buyers who call these cities home will continue to be locked out.

In the absence of a national housing strategy – which is essential and non-negotiable, in my opinion, but which likely will not come for a while – the federal government should reconsider policy measures such as the stress test, which has not stood the test of time. The stress test has also intensified the rental market frenzy, as those who no longer qualify for mortgages are forced to rent, compounding the problem.

For context, the article was written by the President of Re/Max Canada.

Having said that, it’s not exactly wrong, is it?

Looking back at the rock-bottom rates of 2020 and 2021, we should count ourselves lucky that the mortgage stress test was in place.

Borrowers were forced to qualify at much higher rates just “in case” a day came when rates shot up. But that’s exactly what happened, and without the stress test in place, we could have been looking at a surge in arrears or defaults in 2024, 2025, and 2026.

But what about now?

As the cycle of interest rate cuts continues, and with the knowledge that we’ll see more rates in 2024 and then further rates in 2025, is there still a point to qualifying buyers a full 2.00% higher than the posted rates?

Suppose a buyer is looking at a 5.75% variable rate today, with that rate likely going down to anywhere from 5.00% to 4.25% by the end of 2025 (not to mention, that borrower would have the ability to convert to a fixed-rate mortgage below 4%). Why does that buyer need to be qualified at 7.25%?

“Safety.”

That’s what we’re being told.

“It keeps the system safer.”

Sure, but at the same time, the author of the article above isn’t incorrect when he argues that this disproportionally affects first-time buyers.

Then again, not everybody shares my optimism on rate discounts…

“Waiting For Lower Interest Rates? Why Variable-Rate Mortgage Borrowers May See Disappointing Discounts”

The Globe & Mail

September 12th, 2024

From the article:

For example, let’s say you qualify for a five-year variable-rate mortgage rate with a spread of prime minus 1.15 per cent.

Assuming the lender’s prime rate is currently 6.45 per cent, that leaves you with a rate of 5.3 per cent. Now let’s say the BoC cut its benchmark rate again by a quarter-percentage point, and the prime rate falls to 6.2 per cent – that same mortgage rate would now be to 5.05 per cent (6.2 – 1.15).

But your lender decides to reduce their spread by 20 basis points, meaning their variable mortgage rate is now based on prime minus 0.95. The resulting mortgage rate is now 5.5 per cent for a new applicant, based on a 6.45-per-cent prime rate. If there was another quarter-point cut, the rate would lower to just 5.25 per cent. That may seem like a small difference, but can translate into thousands more paid in interest over the lifetime of the mortgage.

Lenders do this for a number of reasons. As a business, protecting revenue comes first and foremost and, when interest rates are already low or falling, they don’t need to price as aggressively to win over variable borrowers. The opposite occurs when central bank rates are on the rise – lenders will improve their spreads to prime to counter waning borrower demand.

It’s a pattern seen in every rate-cutting cycle – even during the emergency rate cuts at the start of the pandemic lockdowns. This time around, the spreads started narrowing in July, as the BoC delivered its second quarter-point cut.

From a borrowers’ perspective, this seems unfair. But, given the economic challenges posed by the large number of mortgages coming up for renewal, it also seems counterintuitive.

If this is the case, then maybe I should take back everything I just said.

Maybe doom-and-gloom is the way to go.

But remember what I said at the beginning about how the media out there at the moment is contradictory?

This article ran on the very same day as the one above:

“With Plumber Profit Margins, Lenders Are Now More Inclined To Pass On The Savings”

Financial Post

September 12th, 2024

From the article:

Mortgage rates are falling like presidential election hopes after a debate disaster. Indeed, fixed rates have dipped in nine of the 10 terms we monitor, with most shedding at least 10 basis points.

Why the lender generosity? Simply put, their costs to fund mortgages have nosedived to multi-month lows. Lender profit margins are now pleasantly plump — enough so to share the savings with Joe and Jane Borrower.

Among national lenders, Pine Mortgage is rocking the popular three-year term with a 4.74 per cent uninsured rate.

And don’t forget those regional providers. Butler Mortgage, for example, is sporting a 4.29 per cent insured three-year fixed in Alberta, British Columbia and Ontario.

As for floating rates — which project to cost less than fixed rates, if you believe bond market projections — Nesto leads the nation with a 5.15 per cent insured variable. Technically, Nesto’s variable is an “adjustable-rate mortgage,” meaning the payments drop as the prime rate goes down. For budget-hugging borrowers, that’s a financial win.

All eyes now shift to Wednesday, when it’s expected we’ll see the first U.S. Federal Reserve rate easing since March 2020. Given that a cut has already been priced in for weeks, the real spectacle will be in seeing how it shakes up bond yields. Lower yields are the ticket to borrowing costs dipping below four per cent.

This article was written by interest rate analyst, Rob McLister.

So why the dichotomy in sentiments?

In fairness to the first article, two days after the Bank of Canada cut interest rates, I was told by a colleague in the lending world, “TD Bank isn’t passing along those twenty-five basis points on mortgages. They’re not dropping their rate accordingly. They’re just pocketing the goddam money.”

But upon speaking to my contact at TD Bank who is currently securing the loan for my latest investment property purchase, I was told, unequivocally, that this isn’t true.

See what I mean about the “uncertainty” and “confusion” in the mortgage market?

As for how and when lower interest rates will affect the market, we have several opinions on this…

“The Moment Where Low Mortgage Rates And Low Real Estate Prices Meet Is Coming”

The Globe & Mail

September 11th, 2024

From the article:

If you’re a home buyer on the sidelines, take note: we’re about to reach that sought-after period when you can purchase a house in a slower, cheaper market where mortgage rates are at a level you can stomach.

Mortgage brokers, realtors and other experts say it is difficult to predict when that moment might come, but it may be in the late fall or early winter if interest rates keep falling consistently. Canadians are still struggling with the impact of inflation and the economy is uncertain, which has prevented the housing market from being whipped into a frenzy by the Bank of Canada’s rate-cutting cycle.

Alright, so the message here is essentially:

-Things are going to get better!

-But we don’t know when

-And we don’t know how

-But it’s going to happen

-We think

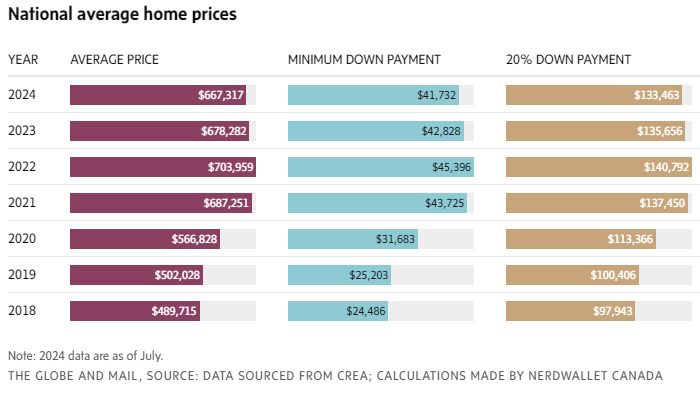

Then further down the article, we’re given this graphic:

Average prices have declined, therefore minimum down payments have declined, and standard twenty percent down payments have declined.

But how does this translate to affordability?

I wish the same chart above had been replicated with carrying cost.

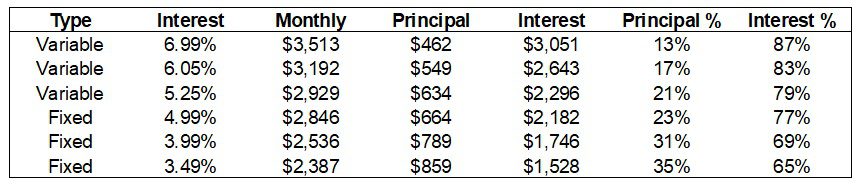

So let’s use the average home price of $667,317 as an exercise and look at the associated costs under the following scenarios:

- 6.99% variable rate mortgage, ie. among the highest we saw in 2023

- 6.05% variable rate mortgage, ie. the typical mortgage after the second interest rate cut this past ummer

- 5.25% variable rate mortgage, ie. the likely variable rate mortgage in early 2025

- 4.99% fixed rate mortgage, ie. a current five-year, fixed-rate mortgage

- 3.99% fixed rate mortgage, ie. a likely five-year, fixed-rate product that we’ll see in spring or summer of 2025

- 3.49% fixed rate mortgage, ie. my dream scenario for a five-year, fixed-rate mortgage by the end of 2025

For the purposes of this exercise, we’ll assume a 30-year amortization on a purchase price of $667,317, with a 20% down payment:

I’m probably not telling you anything you don’t already know, but for some of you, perhaps seeing the figures stacked up against each other is helpful.

Yes, as interest rates decline, so too do mortgage payments.

But as far as the “average home price” goes, the affordability at the peak – $3,513 per month at a 6.99% rate, is $700 cheaper today on a fixed-rate mortgage, and if you can stomach the higher payments for another 4-6 months, there’s another $300 from there too.

A five-year, fixed rate of 3.99% is a reality next spring and that is what many buyers are working their numbers around.

Can you afford the payments on today’s 5.85% variable rate?

If so, then you can safely forecast a fixed-rate in March, or May, or July that you can lock into, and it’s going to be much, much lower.

Last, but certainly not least, having already written the preceding over the weekend, I certainly wasn’t prepared for this surprise from the federal government on Tuesday:

“Freeland Allowing More 30-Year Mortgages, Higher Values For Insured Mortgages”

Financial Post

September 16th, 2024

First and foremost, this is an odd title, isn’t it?

Freeland allowing.

Really?

Is it her, personally? No, of course not.

But the press conference and Ms. Freeland’s comments reeked of, “Hey, look what we’re doing to help you” for the younger generation who want so badly to be homeowners.

From the article:

Freeland announced that starting on Dec. 15, the cap for insured mortgages will rise to $1.5 million from the $1-million cap today. This would allow buyers to qualify for larger mortgages without putting 20 per cent down.

On the same day, the government is also expanding the availability of 30-year mortgages. In the spring budget, the government expanded the eligibility of those long-term mortgages to new buyers who were purchasing new builds.

But now the 30-year availability will apply to both new buyers and people buying new construction homes.

Freeland said the changes will put more buying power into the hands of first-time home buyers and give them an advantage in the market.

There’s a lot to unpack here.

First: the ‘cap’ on insured mortgages rises from $1,000,000 to $1,500,000.

I remember when the government mandated buyers must have a 20% down payment on properties over $1,000,000. That literally caused $800,000 properties to shoot up in value to $950,000+ in the fall market that year. Every single buyer out there suddenly had a cap of $999,999, and it put so much pressure on that segment of the market that all those $699,900 listings, that might have sold for $800,000, started to push $1,000,000 because of the demand.

Will the same thing happen this time around?

I don’t think so.

My cynical side says, “Oh, great, the government is helping first-time buyers by allowing them to take on more debt!”

Look at this quote from Ms. Freeland:

“I think this is really a question of recognizing economic reality,” she said.

Right.

Or, maybe, “recognizing economic reality” is acknowledging the government driving the economy into the ground over the last decade and spending money like inebriated nautical servicepersons.

Tomato, Tomaaahto.

The second change in the announcement concerns the amortization period, which can be extended from 25 years to 30 years, thus lowering monthly mortgage payments.

The more I think about it, the more I realize this latest announcement necessitates its own dedicated blog post.

Yes. We shall do that. That, we shall do.

Seriously though, I wasn’t prepared for this announcement, but had I not included this news in today’s blog post and instead waited until Monday, I know y’all would have hijacked the comments section. 🙂

So let me conclude with this: even before Tuesday’s announcement, we were already hearing more and reading more about the mortgage market than at any other point in the last half-decade.

For those who can’t wait until Monday, I have a podcast being released on Friday that talks about this recent CMHC announcement at length.

For the rest, have a great weekend and I’ll be back on Monday to talk sexy talk about mortgages…